In today’s fast-paced digital landscape, businesses face challenges in securely verifying identities, complying with regulations, and implementing fraud prevention and customer onboarding solutions. That’s why we offer an innovated business solution, DocuPass.

1. Advanced Fraud Prevention and Enhanced Security Solutions

Cybersecurity threats and identity fraud are on the rise, with businesses losing billions annually to fraudulent activities. DocuPass’s automated document verification leverages advanced AI technology to detect fake IDs, tampered documents, and other fraudulent attempts. By integrating DocuPass, businesses can:

- Authenticate identity documents such as passports, driver’s licenses, and national IDs in real-time.

- Ensure that uploaded photos and videos are genuine through facial recognition and liveness detection.

- Prevent unauthorized access and fraudulent sign-ups.

2. Streamlined Customer Onboarding and Verification Solutions

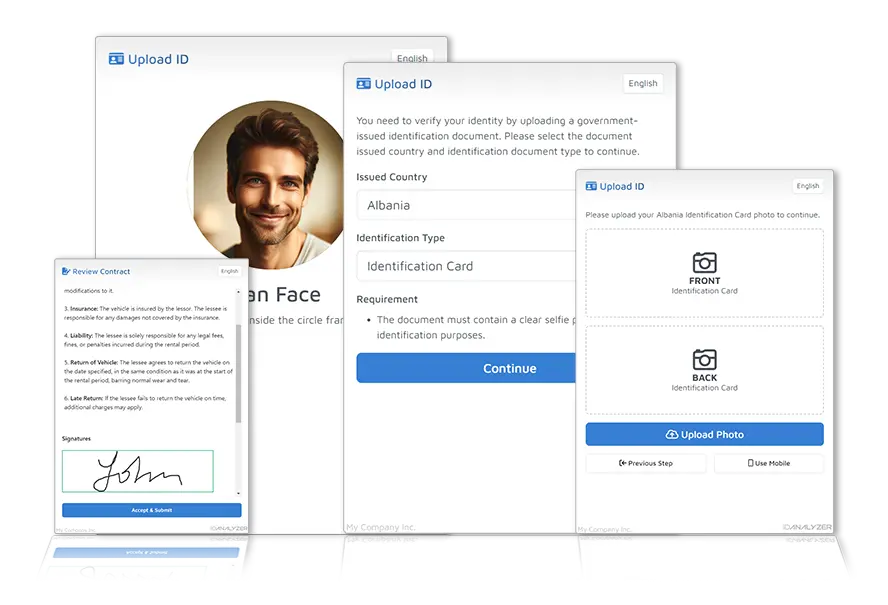

A lengthy or complicated onboarding process can drive customers away. DocuPass simplifies identity verification by offering:

- Easy-to-use interfaces for uploading documents via smartphones or desktops.

- Rapid processing of identity verification, reducing wait times to just seconds.

- Integration with platforms like websites, mobile apps, or kiosks to provide a seamless user experience. This not only improves customer satisfaction but also increases conversion rates.

3. Ensure Compliance with Global KYC and AML Standards

Businesses across industries, particularly in finance, insurance, healthcare, and e-commerce, must comply with strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Failure to adhere to these regulations can result in hefty fines and reputational damage. DocuPass ensures compliance by:

- Providing electronic KYC solutions that meet global standards.

- Ensuring data privacy and security with GDPR and CCPA compliance.

- Offering detailed audit trails and reports to simplify regulatory checks.

4. Cost-Effective Identity Verification and Scalable Solutions

Manual identity verification is resource-intensive and not scalable for growing businesses. DocuPass offers a cost-effective solution by automating the entire process. Businesses can:

- Save on labor costs by reducing the need for manual checks.

- Scale effortlessly as customer demand increases, with pay-as-you-go pricing models.

- Choose between cloud-based or on-premise deployments to suit their infrastructure.

5. Customizable Identity Verification Solutions for Your Business

Every business has unique requirements. DocuPass provides flexibility with:

- API and SDK integration for tailored workflows.

- Multi-language support to cater to a global audience.

- Customizable branding to ensure the identity verification process aligns with your company’s look and feel.

6. Versatile Fraud Prevention Solutions for Multiple Industries

DocuPass is not limited to one sector. It’s designed to serve various industries, including:

- Financial Services: For opening accounts, loan applications, and KYC compliance.

- E-Commerce: To verify customers for high-value transactions.

- Healthcare: For patient verification and securing medical records.

- Shared Economy Platforms: To authenticate users for rentals, ridesharing, and gig platforms.

Conclusion

In an era where trust and security are paramount, integrating a robust identity verification solution like DocuPass is no longer optional – it’s essential. With its advanced features, ease of integration, and focus on compliance, DocuPass empowers businesses to streamline operations, build customer trust, and stay ahead of regulatory requirements.

By integrating fraud prevention and onboarding solutions, businesses can streamline their customer verification processes. For more information or to schedule a demo, visit ID Analyzer’s website.